Hiring a nanny for child care can mean tax liabilities you didn’t have before, even if they aren’t a full-time employee. Here’s what you need to know about the nanny tax.

Business Help Archives - Page 4 of 7 - GG Advisors LLC

The IRS has temporarily expanded its e-signature allowance to include several additional tax forms. Review the complete list and restrictions here.

The FFCRA requires employees who take leave or sick time due to COVID-19 to be reported separately to employees on Form W-2. Learn how to report them correctly.

The Employee Retention Credit (ERC) has been expanded until Dec. 31, 2021. Don’t assume your business is ineligible for the ERC.

Tax planning can help any business save money on taxes and minimize errors in tax filings. Here are some strategies to start tax planning.

Since the pandemic, the IRS has temporarily changed the tax-deductible amount allowed for some business meals to encourage increased sales at restaurants

Summer Reminder: Safe Harbor Rules for Rental Real Estate

Recent updates to 1031-exchange regulations provide new details on the definition of real property and incidental property and provide new means for testing fixtures involved in like-kind property exchanges.

Avoid these top audit triggers and make sure your business is following best practices to avoid an IRS audit this year.

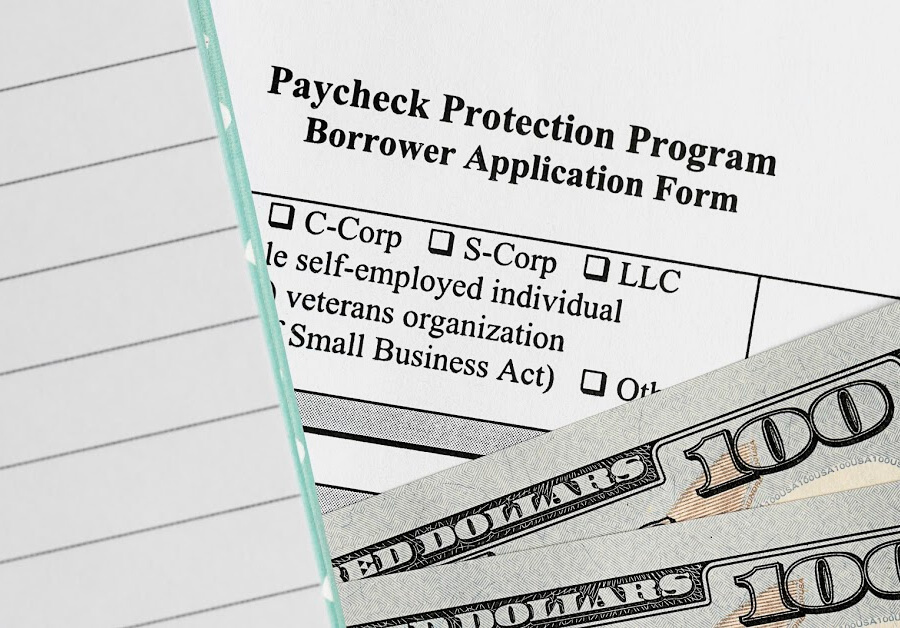

A measure to extend the Paycheck Protection Program (PPP) application deadline from March 31, 2021, to May 31, 2021, has passed the U.S. House of Representatives and the Senate. It now heads to President Biden’s desk for signature which he is expected to do promptly.