When it comes to setting financial goals for your business, there are two main methods to consider: budgeting or forecasting. Given the changes in the business environment today, it may even make sense to combine the two as part of your strategy.

Tax: Individual Archives - Page 3 of 4 - GG Advisors LLC

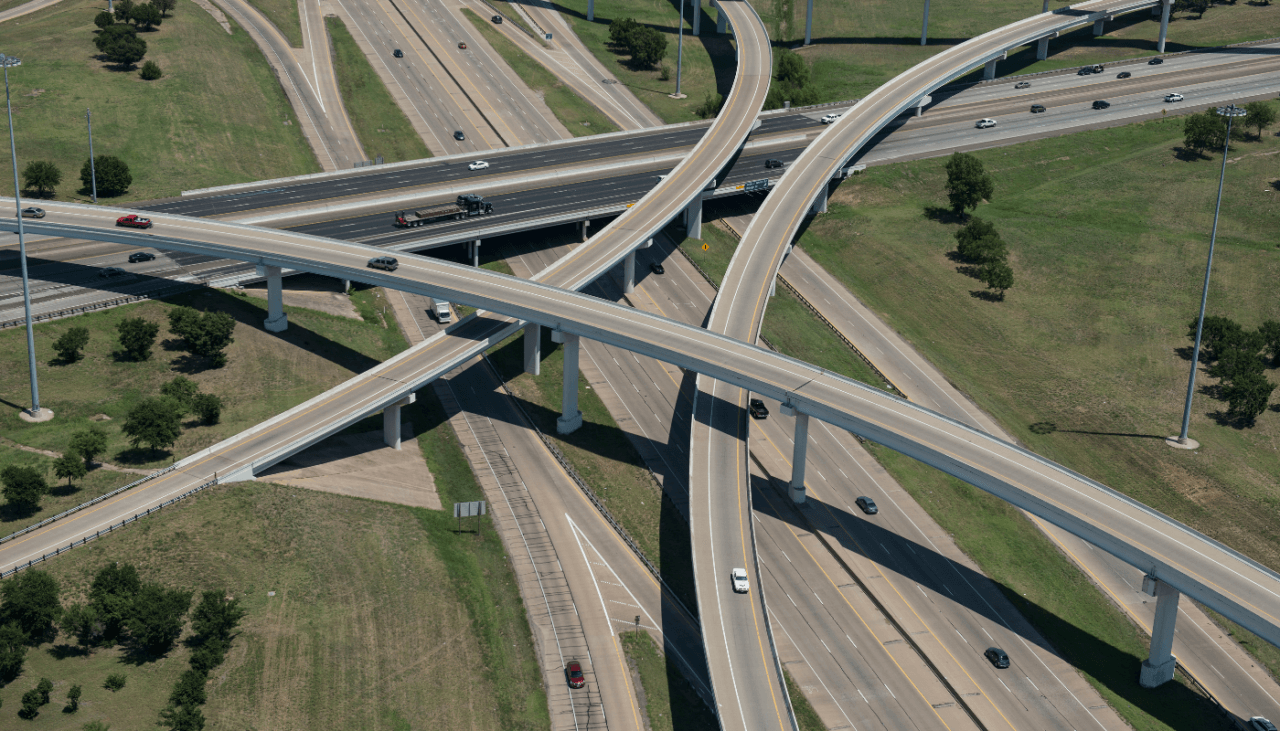

The IIJA (Infrastructure Investment and Jobs Act) provides plans to reconnect communities previously divided by highway building and expand broadband networks. Learn more about what it means for small businesses and individuals.

With the rise of VRBO and Airbnb, allowing short-term rentals on a vacation home are becoming more popular. Here’s what you need to know about vacation home taxes.

The IRS recently released information on how to check eligibility, opt-in for non-filers, and opt-out of the advance child tax credit payments as part of the ARP.

The IRS is cracking down on cryptocurrency reporting on tax documents. Here's what you need to know to properly report gains and losses on your tax return.

The American Rescue Plan Act (ARPA) has been signed into law by President Biden and makes significant updates to several tax provisions to alleviate some of the pandemic's financial burdens for individual taxpayers and businesses. Updates include expansions and extensions of various tax credits such as the employee retention credit (ERC), COBRA continuation coverage, Affordable Care Act (ACA) subsidies, and more. The bill also includes $1.46 billion for the IRS to manage the additional responsibilities on top of the annual tax filing season. Here are the critical tax updates.

The American Rescue Plan Act (ARPA) of 2021 passed Congress and President Biden signed the bill into law on March 12, 2021. The ARPA approves $1.9 trillion in spending for individuals, businesses, governments, and certain industries impacted by the COVID-19 pandemic. The third Act in a year, the ARPA approves additional economic impact payments for individuals; the extension of federal unemployment benefits; additional funds for Paycheck Protection Program (PPP) Loans, and Economic Injury Disaster Loans (EIDL) for hard-hit small businesses; and grants for food and beverage establishments. Here are the key individual and business provisions in the bill.

The U.S. House of Representatives and U.S. Senate passed, and the President has signed, the Coronavirus Response & Relief Supplemental Appropriations Act. The agreement comes after weeks of negotiations and two funding extensions to keep Congress open until a bill was passed with a $1.4 trillion government-wide funding plan. The $900 billion coronavirus relief portion includes another round of Paycheck Protection Program (PPP) funding, extended unemployment benefits, and direct payments to taxpayers. Here’s an overview of the key provisions in the bill.

The pandemic created by the novel coronavirus has drastically changed the way we live and work. As more businesses are forced to send their employees home, work-from-home life has become a mainstay especially in knowledge-based jobs (jobs that do not require physical labor), and many of these industries are not going back to the workplace anytime soon. This can create wrinkles for both employers and employees when it comes to their tax situations.

Reviewing your tax situation each year prior to filing is essential to ensuring your compliance is up to date and opportunities have been optimized. This guide contains strategies to help you save on your taxes if enacted before year-end. For assistance or further detail, contact your Goering & Granatino team member at (913) 396-6225.