Unlock the significance of enhancing invoice processing and actionable strategies to bolster cash flow.

Amber Goering, Partner, Author at GG Advisors LLC - Page 4 of 10

“An exemption from UNICAP? And no limitation on the amount of business interest expense I can deduct? Sign me up!”

Now is an opportune moment to assess the practical impacts of the Lease Accounting Standard changes on companies and explore the latest updates to these standards.

With $2.7 trillion of debt expected to mature by 2027, coupled with higher interest rates, it is no surprise we are seeing more than one-quarter of real estate companies seeking to modify their debt agreements.

Explore the many factors that drive CEO compensation within the family-owned business.

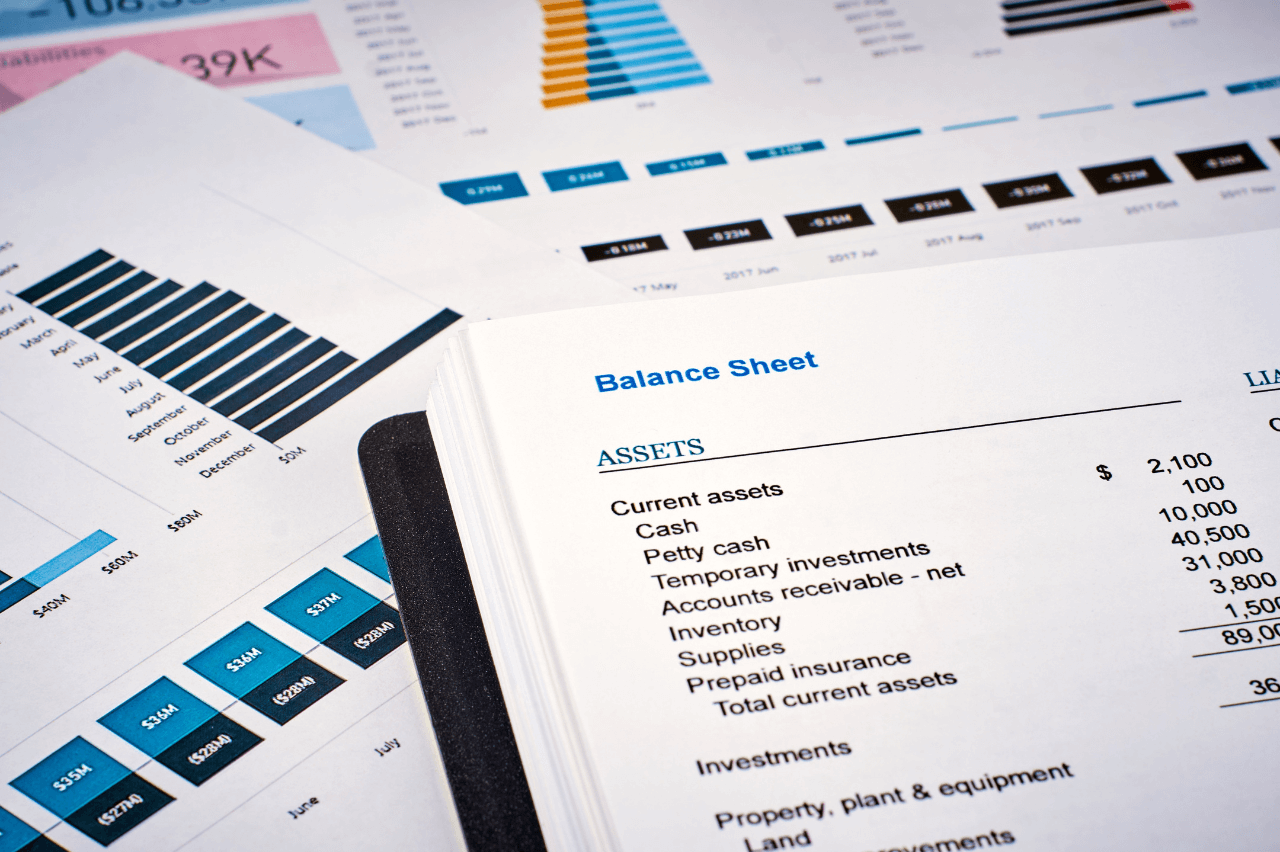

As a business owner, improving your financial management can open doors to many possibilities. This article will explore essential tips for leveraging accounting software, particularly QuickBooks, to boost your financial oversight and operational efficiency in 2024.

The SECURE Act mandates a new 401(k) requirement for employers with long-term, part-time employees.

Embark on a journey of strategic financial navigation with our exclusive 2023 Year-End Guides.

Dive into the 2023 Year-End Guide on Business Incentives & Tax Credits.

As 2023 draws to a close, employers should review whether they have properly included the value of common fringe benefits in their employees’ and (if applicable) 2% S corporation shareholders’ taxable wages.