2024 Year-End Tax Planning Guide: Key Strategies and Updates for Navigating International Tax Compliance and Optimization.

Articles - Page 4 of 18 - GG Advisors LLC

2024 Year-End Tax Planning Guide: Insights and Strategies for Global Employment Services to Optimize Compliance and Benefits.

As 2024 ends, U.S. importers face rising tariffs. Explore duty mitigation strategies to manage costs and adapt to evolving policies.

Year-End Planning Guide: Strategies for Corporate and M&A Success in Closing the Year with Optimized Tax and Business Opportunities.

Year-End Planning: Explore STS Business Incentives and Tax Credits strategies to maximize your savings and optimize your tax position.

Prepare for ASC 740 updates with insights on ASU 2023-09 and tips for effective income tax accounting and disclosure compliance.

Explore strategies to optimize federal tax positions through accounting method changes for cash savings and tax planning.

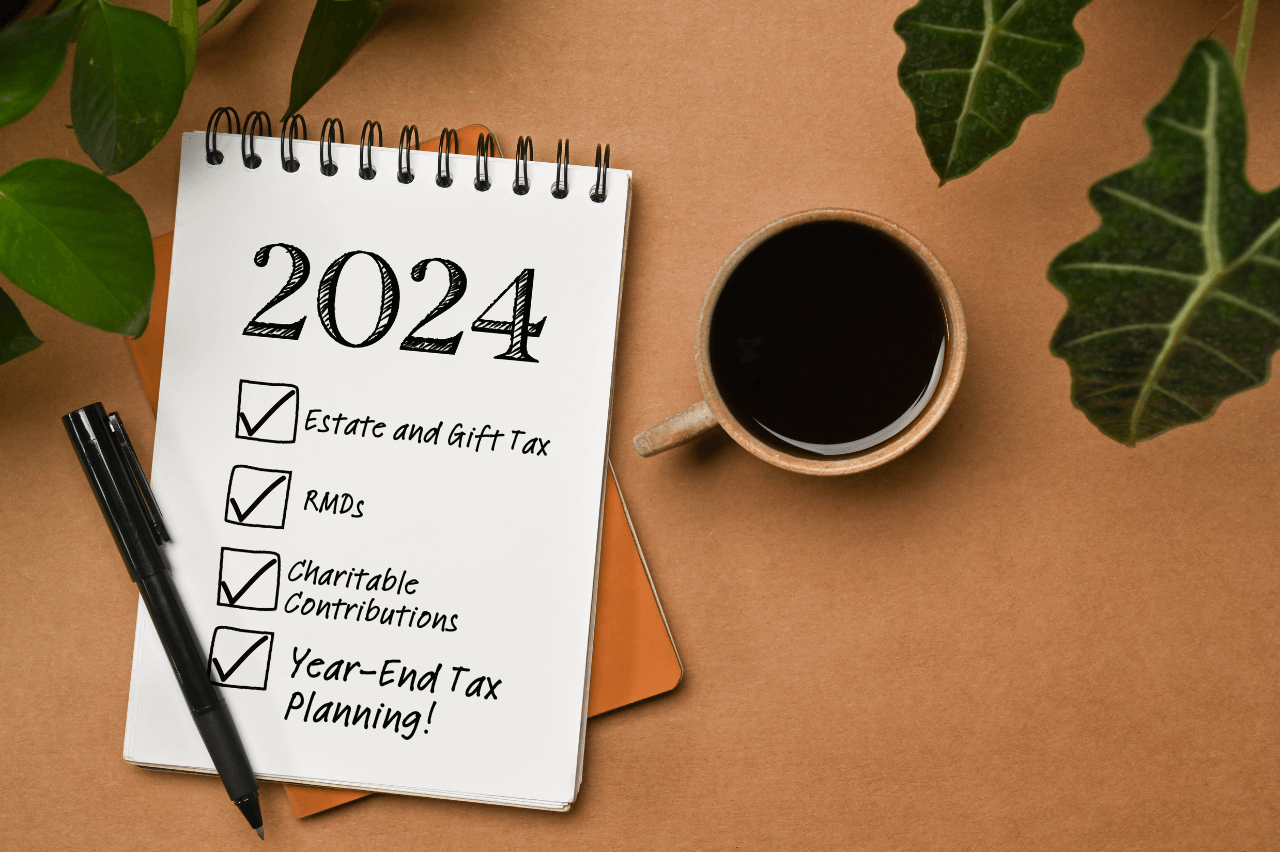

As the end of 2024 approaches, it’s time to consider your year-end tax strategies and considerations for 2025. Here’s what you need to know to optimize your tax position.

As a business owner, you already know the importance of setting a budget to help you manage income, expenses, and investments. But did you know that budgets are living documents that need regular review and revision to stay relevant?

Discover three ways to reduce income tax reporting risks and improve controls in a complex tax accounting environment.